Depending on your view, you may see the new tax law as great for our GDP, or an unacceptable increase in our national debt. If we put politics aside for the following article we can focus on businesses in the short term. We can see if this is a sham or the perfect time to make your business more efficient by investing in new measurement equipment.

Pass-Through Businesses

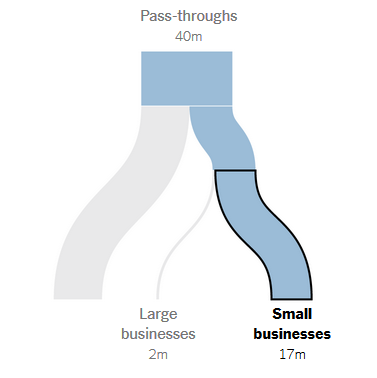

First, we might want to know what is a Pass-Through business? A pass-through business is a company that does not pay corporate taxes. They are structured as a sole proprietorship, partnership or S-Corporation. This means the profits from these companies are reported on the owner’s personal tax returns. The owners pay taxes on their personal and business income all together. More than 95 percent of business tax filings are pass-through businesses. It could be a machine shop or the cleaning company that mops the floors. If you own your business and it is structured as a sole proprietorship, partnership or S-Corporation you may save some money.

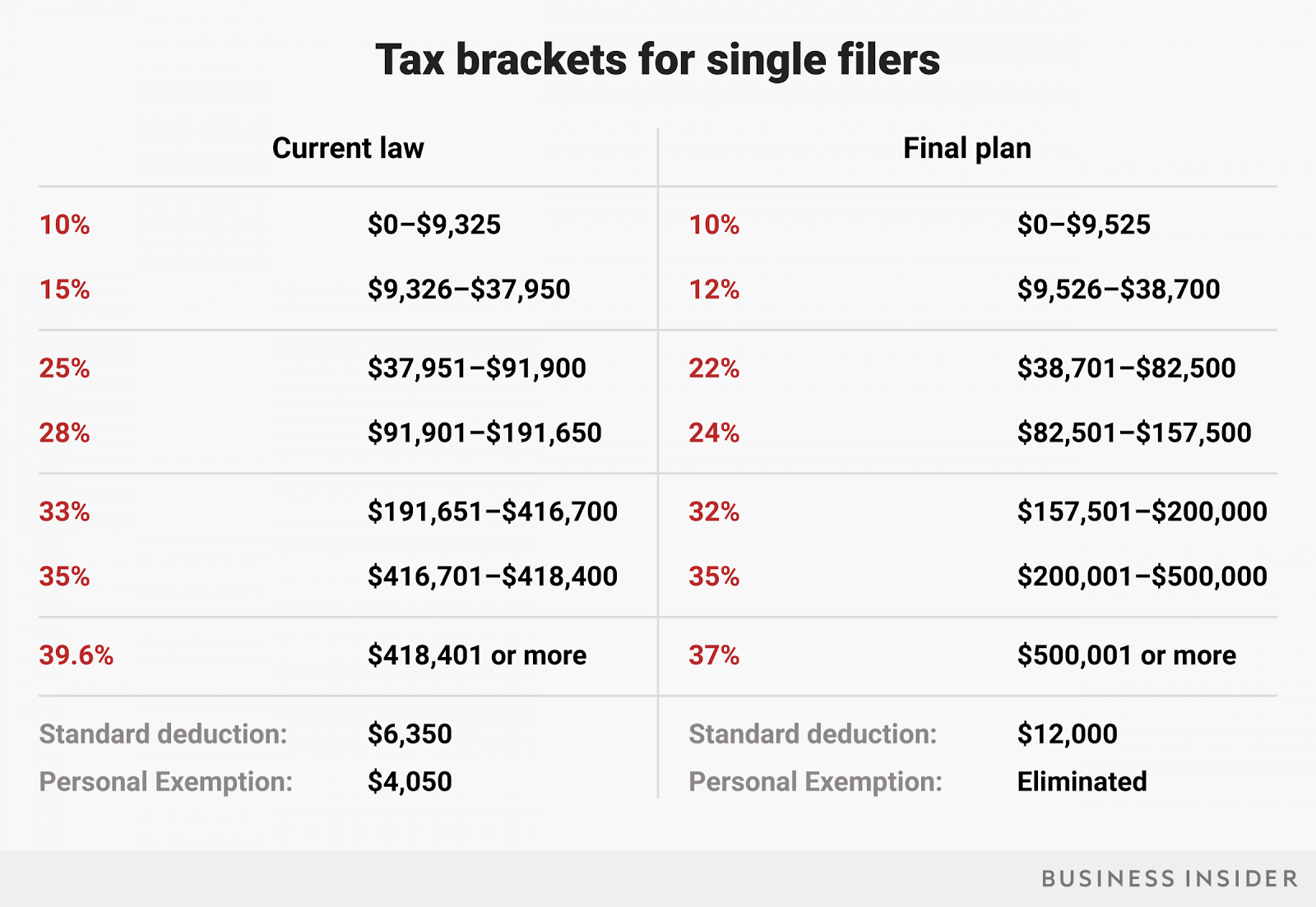

Under the new law, all pass-through businesses that are not service based, will receive a 20% tax deduction off your entire taxable income. For an example let’s say you own a business and you personally make $120,000 in 2018 and your business has a profit of $380,000. Under the old tax plan, the total $500,000 would be taxed as personal income. Under the new plan you take 20% off the $500,000 so your new taxable income is $400,000. Assuming no other deductions to keep the math simple and using the handy tax calculator at taxact.com. For the $500,000 2017 taxes you would owe $153,818.85. In 2018 for $400,000 (20% off $500,000) you would owe $115,070.25. This is a $38,748.60 savings per year for what I would assume will last for at least the next three years.

For most of us, it may seem unlikely that we could make a half million dollars in a year but for millions this could be the case. According to the Tax Foundation and Tax Policy Center there are 17 million small businesses in the U.S. and around 6 million of these businesses make between 1 million and 10 million (10 million is the cut off for a small business). You can see from the math in the above paragraph that the more you make the more you will save. What this tax cut assumes is that these owners will re-invest the savings into their business.

Slashing the corporate tax rate

The biggest change to the tax code is the reduction in the corporate tax rate. The current rate in the U.S. for a corporation is 35%. Meaning that 35% of the income the company generates will go to the government. While this is high if you compare it to other countries (England is around 20%), because of loop holes the effective tax rate is around 18% for the U.S. This higher tax is being blamed for driving companies to move their headquarters to other countries. Right here in Michigan we lost FCA headquarters to London England. While we were lucky that most of the jobs stayed in Auburn Hills, the tax revenue from their 1.814 billion euro 2016 profits went to England’s government not ours. Time will tell if this is true, but the hope is, that lowering the corporate tax in the U.S. will help companies stay in the U.S. and might bring companies like FCA back.

The new tax rate in 2018 for corporations in the U.S. is 21%. If we use General Motors Company as the example, we can estimate the savings. Again, we will look at the tax rate only as I cannot account for loop holes or tax havens in the Cayman Islands, both of which are supposed to be eliminated with the lower rate. How? Well if the company is hiding 10% of their revenue in another country to save on taxes we in the U.S. will never see a dime. If the government lets the companies keep this extra 10%, it still will not help the government, but it does stay in the United States. This money can go to pay shareholders, but it can be invested in new equipment or raises for employees as well. So back to GM. In 2016 GM had a net income of 9.427 billion dollars under the old law they would owe $3.3 billion in taxes. Under the new law they would owe $1.97 billion in taxes. Again, time will tell if GM invest in CEO’s or employees’ wages and equipment, but they are looking to save around 1.3 billion dollars.

In times of plenty it is easy to lose track of the future while swimming in profits. Currently the economy is up. People are buying, and companies need to make more things to sell. This tax reduction for business is just adding to the possible “piles” of money. If the recession from 2008 to 2010 as showed us anything it is that, what goes up always comes down. Now is the time to invest in products the make your business more efficient. Now the money is available to lower labor costs and improve product quality. If done right, the next down turn will hurt but it won’t be a killer like the great recession where 170,000 small businesses called it quits.

In businesses across the U.S. the attitude has been, “if it doesn’t make (metal) chips it doesn’t make

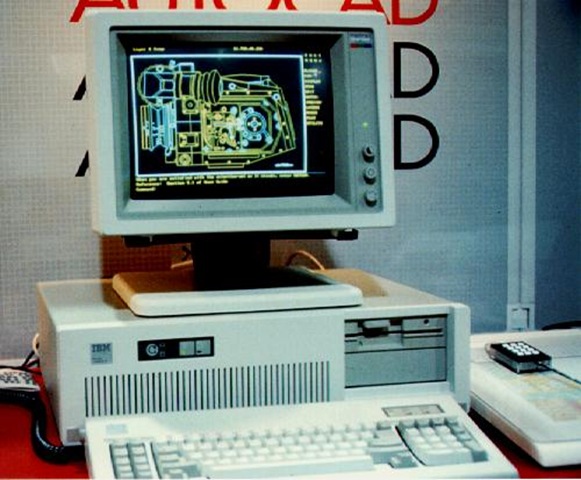

In businesses across the U.S. the attitude has been, “if it doesn’t make (metal) chips it doesn’t make  money”. This has led to high investment in machine tools and their support equipment. While this might be a good strategy to have when money is tight, this did leave many quality labs with outdated or broken equipment.

money”. This has led to high investment in machine tools and their support equipment. While this might be a good strategy to have when money is tight, this did leave many quality labs with outdated or broken equipment.

As many businesses know the OEMs and tier ones are demanding more and more quality out of their suppliers. This level of quality is becoming impossible to achieve without specialized or new measurement equipment. Now is the time to invest in measurement. Get your quality labs ahead of the OEM and make your quality staff more efficient. This way when times are tough you will still be making quality parts without the need for an emergency loan when an OEM asks for 2 tents instead of 5.

As always check us out at www.wenzelamerica.com or you can contact us here.