While reading through our older blog posts I came across an article written by my sales rep Mike Bingham in 2014. Click here if you would like to read it!

While reading through our older blog posts I came across an article written by my sales rep Mike Bingham in 2014. Click here if you would like to read it!

In his article he describes how the U.S. economy as it is emerging from the “great recession” and how the U.S. would remain number one in GDP. While I am far from an economist, I thought it would be interesting to compare his 2014 numbers with 2016 to see how well we have recovered.

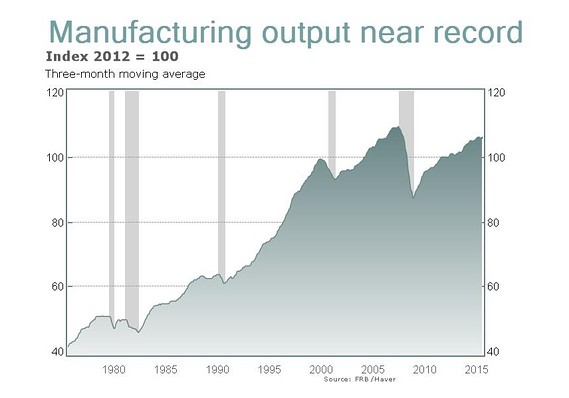

Today when we talk about manufacturing and industry in this country, we talk about high stock prices, great profits and growing markets. This statement is directly opposite to Mike’s findings 3 years ago.

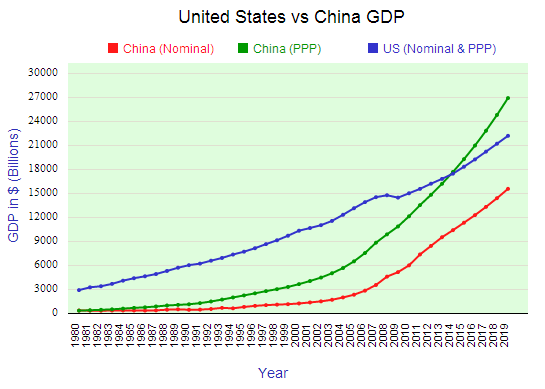

Back in 2014 some economists were still predicting China will overtake the U.S. in nominal GDP by 2020. Let’s look up some facts and see how far they were off.

There was good reason for economists to think China could overtake the U.S. From 2010 to 2014 China’s GDP grew on average 8.5% each year. Compare that to the U.S.’s growth of 2% during the same 4 years and you can see it was just a matter of time until China was the biggest economy in the world.

While it is true that China is still growing faster than the U.S., the average hides China’s secret. Every year since 2010 China’s growth has slowed down from 10% to 6.7% in 2016.

Many have attributed this decline to an increase in expected wages and a shift from a manufacturing to a service economy. This is similar to the United States in the 70’s and 80’s. As China continues to develop, its growth will slow to between 2% to 3 % just like the EU or the U.S.

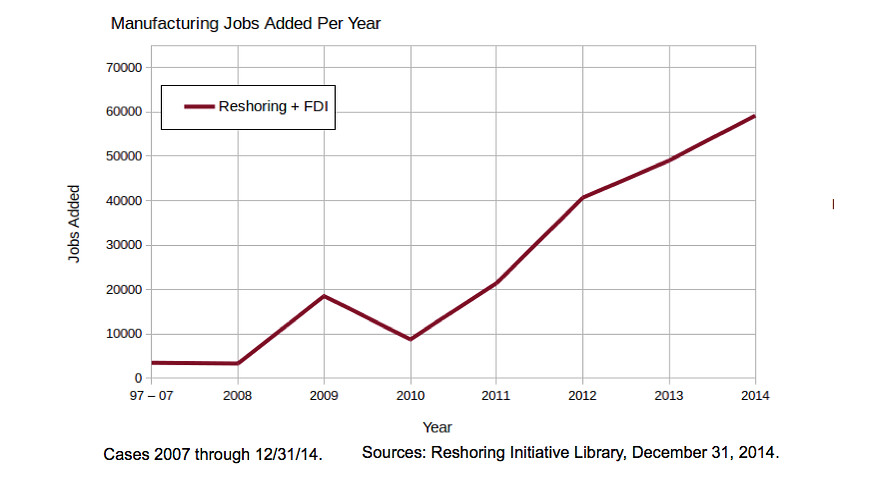

Great news for the United States! As China’s market becomes more like the U.S., their labor costs will continue to rise. This alone makes U.S. workers more competitive and this rise in labor costs will make Chinese goods closer to the price of U.S. goods.

This means U.S. exports will rise and more manufacturing jobs will be created. More medium wealth jobs in the U.S. equals more money in the market to buy more manufactured goods, meaning more manufacturing jobs and so on.

The second benefit to rising wages in China benefit is that more of their 1.3 billion consumers will have disposable income. This opens an ever-expanding market for U.S. goods. If you make auto, aero or industrial parts this is a great time for you.

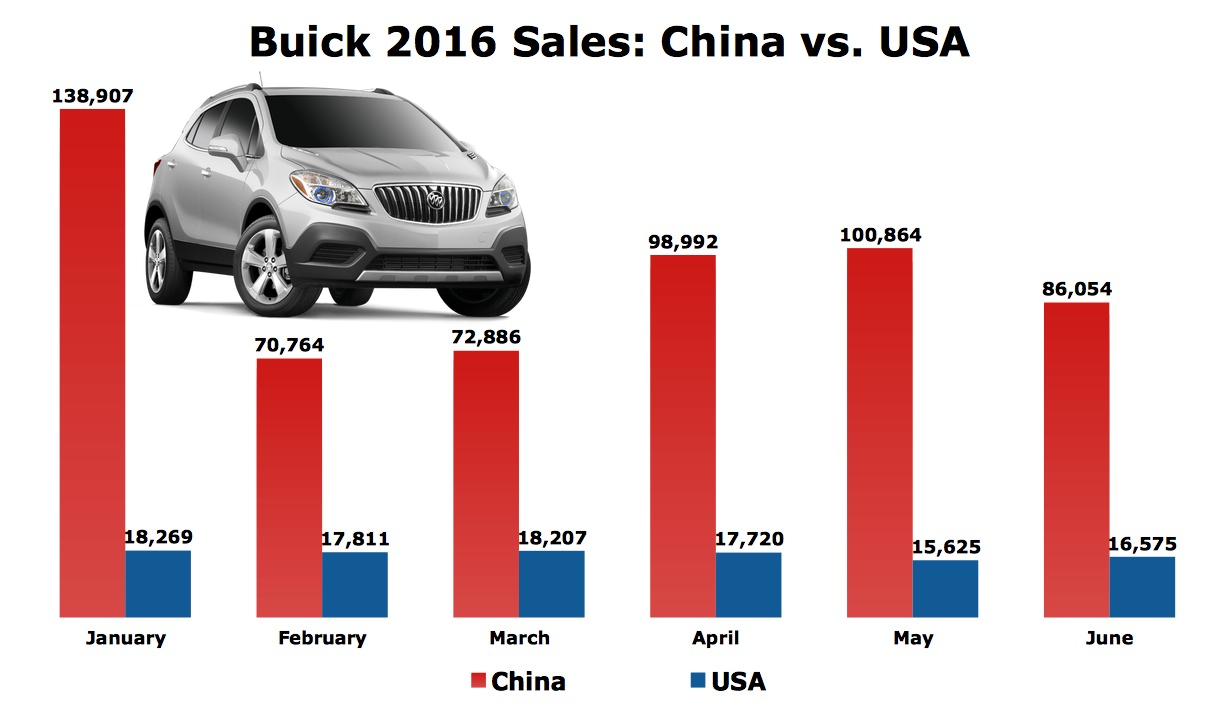

A great example of this is Buick. Buick sells 8 times as many cars in  China as it does in the U.S. to the tune of 880,000 in 2016. Buick is a U.S. brand that has capitalized on the new Chinese middle class. All of us in manufacturing should be looking to expand in the U.S. and China. We can fill a need for manufactured goods before new startups fill it for us.

China as it does in the U.S. to the tune of 880,000 in 2016. Buick is a U.S. brand that has capitalized on the new Chinese middle class. All of us in manufacturing should be looking to expand in the U.S. and China. We can fill a need for manufactured goods before new startups fill it for us.

It is good to think we are passed the doom and gloom of the “great recession”. So again, let’s look back at Mike’s numbers and see if we came out ahead. Below is a short list of countries and their GDP numbers from 2014 and 2016. The real winners are China and the U.S. who grew by 1.2 and 1.1 trillion respectively. This should drive home the need for expansion in the manufacturing sector. So we can fill the growing wants for goods. The big loser is Russia. With tough sanctions after the invasion of Ukraine and military actions in Syria their economy is half it once was.

2014 GDP verses 2016 GDP (in trillions of USD)

U.S.A $17.5 / $18.6

China $10.0 / $11.2

Japan $4.8 / $4.9

Germany $3.9 / $3.5

U.K. $2.8 / $2.6

Russia $2.1 / $ 1.3

India $2.0 / $2.3

Mike said “The biggest advantage we have always had in the United States is the quality we produce and the innovation we create. You can’t find that anywhere in the world and certainly not for pennies.” This is still our biggest asset. Combine this with rising wages across the globe and the future of U.S. manufactured goods looks very bright!